Can You Have Multiple Properties With A Single VA Loan?

Can You Have Multiple Properties With A Single VA Loan? You’re trying to buy a property and it includes more than one parcel or lot

Carlos Scarpero- Mortgage Broker

You're trying to buy a property and it includes more than one parcel or lot number. Maybe you want the extra acreage behind the house, or there are two structures on adjacent lots. The good news is that a VA loan can cover multiple parcels—but there are rules, practical limits, and plenty of lender interpretation that can make the difference between smooth approval and a denial. This post breaks down what the VA requires, how underwriters actually treat multiple parcels, and what steps you should take to avoid surprises.

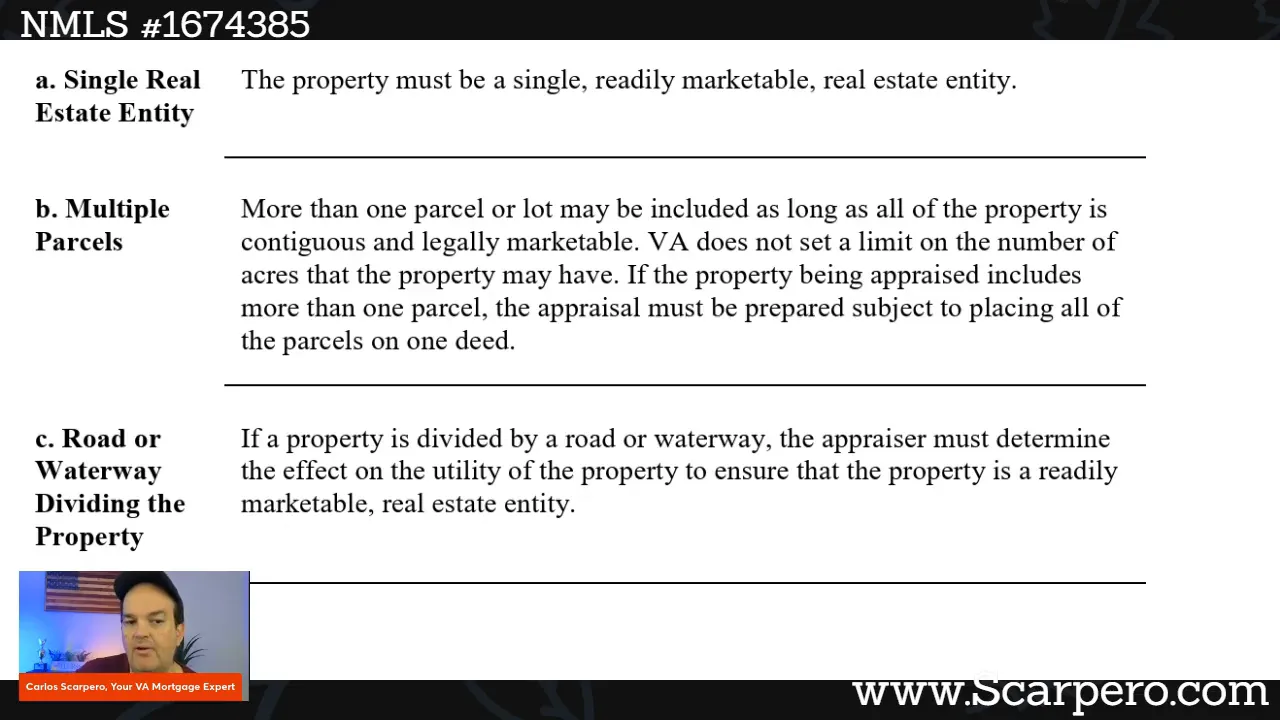

The starting point is the VA Handbook, Chapter 12, Minimum Property Requirements. The core principle to remember is this: the property must be a single, readily marketable real estate entity.

Although VA guidance is clear in principle, lenders and underwriters often apply additional interpretation. Below are the common scenarios and how they typically play out.

If all structures sit on a single lot number, most lenders treat the property as a multiunit property. VA allows up to four units on a single loan. That means a fourplex, two duplexes on the same lot, or a main house with accessory units on the same parcel are usually fine.

You must occupy one of the units as your primary residence, and the other units can be rented. This is one of the clearest “yes” situations you can encounter.

If the seller is including an adjacent vacant lot that is contiguous to the primary lot, lenders commonly allow the parcels to be combined into a single VA loan. Think of it as buying the house and a larger backyard in one transaction.

Two practical requirements here are that the parcels are contiguous and that the title work can place both parcels on the same deed for the loan and appraisal.

When you try to buy two separate houses on two separate lot numbers as a single transaction, lenders often push back. Why? Because that can look like two independent real estate transactions packaged together.

For example, one real-life situation involved a main house on one lot and a neighboring lot with a mobile home. The lender viewed those as two distinct transactions. They requested separate closings: one for the lot and house, one for the lot with the mobile home. If the neighboring mobile home lot were vacant instead, many lenders would accept it—because a vacant lot combined with the primary lot usually reads as one marketable entity.

The VA handbook explicitly allows parcels divided by a road or waterway if the appraiser determines the division does not impair the property’s utility. In practice, appraisers and underwriters will focus on how the division affects marketability. If the divided layout makes the property awkward to sell, lenders may be reluctant.

Take the 30 second mortgage quiz to see if you qualify |

| Start The Quiz |

Whether you are the buyer or the agent, being proactive with documentation will save time and reduce the chance of denial.

Yes. The VA allows multiple contiguous parcels to be included on a single VA loan as long as the combined property is a single, readily marketable real estate entity. Title and appraisal requirements must be met, including combining parcels on one deed for the appraisal.

The VA handbook does not set an acreage limit. Practical limits come from lender policies, appraisal concerns, and whether the property remains marketable. Some lenders might impose acreage limits under their own guidelines.

The appraiser must evaluate whether the division affects the utility and marketability of the combined property. If the appraiser determines the divided layout still reads as one marketable entity, the parcels can be included.

It depends. If the mobile home is considered a separate, habitable structure on its own lot, a lender may view that as two transactions. If the lot is vacant or the mobile home is demolished, approval is more likely. Lender interpretation varies.

Ask for the specific reason in writing and then get a second lender opinion. Different lenders and underwriters interpret VA rules differently. A broker who shops multiple lenders can often find a program that will accept the parcels.

The VA allows multiple contiguous parcels on one loan, but the practical outcome depends on title, appraisal, and lender interpretation. If your deal includes multiple lot numbers, verify early with the lender, coordinate title work so parcels can be combined on one deed, and be prepared to shop lenders if you hit resistance. With the right documentation and the right lender, you can often bundle extra acreage or adjacent vacant lots into a single VA loan—just make sure you plan for the appraisal and title steps up front.

Can You Have Multiple Properties With A Single VA Loan? You’re trying to buy a property and it includes more than one parcel or lot

How To Get A VA Loan When You Work On Commission If you earn commission instead of a steady salary, qualifying for a VA loan

Can You Refi a VA Loan With Bad Credit? If you have a VA loan and a low credit score, you might assume refinancing is