Can You Have Multiple Properties With A Single VA Loan?

Can You Have Multiple Properties With A Single VA Loan? You’re trying to buy a property and it includes more than one parcel or lot

Carlos Scarpero- Mortgage Broker

Summary: If you've experienced a business bankruptcy and are looking to buy a home, there is a lesser-known VA and FHA loan guideline that might significantly reduce your waiting period before qualifying for a home loan. This article explores this unusual rule, the specific conditions you must meet, and how it can benefit veterans and non-veterans alike. Whether you’re self-employed or have recently transitioned into a permanent position, understanding this exception could help you achieve homeownership sooner than you thought possible.

Buying a home after a bankruptcy can feel daunting, especially when it comes to understanding the waiting periods imposed by lenders and loan programs. Typically, these waiting periods are designed to ensure that borrowers have re-established financial stability after a bankruptcy before they take on a new mortgage.

For VA loans, the waiting period usually starts from the date of bankruptcy discharge or filing, depending on the type of bankruptcy you filed. However, there is a special rule that can reduce this waiting period if your bankruptcy was caused by a business failure. This same rule also applies to FHA loans, making it relevant for a broader range of borrowers, not just veterans.

The waiting period is the time between the bankruptcy event (filing or discharge) and the closing date of your new home loan. It’s important to note that the waiting period is measured until loan closing, not the application date. This means you can apply and go under contract before the waiting period ends, but your closing date must occur after the waiting period expires.

There are different bankruptcy chapters, and the waiting periods vary accordingly:

These waiting periods are designed to ensure that borrowers have had sufficient time to rebuild their credit and financial stability after bankruptcy.

This is where the rule gets interesting for those who filed bankruptcy due to business failure. If your bankruptcy was caused by your self-employment or business failure, the VA guideline allows the standard two-year waiting period to be reduced to just one year.

This exception is outlined in Chapter 4 of the VA Handbook and applies under specific conditions. It also applies to FHA loans, making it beneficial for a wider audience.

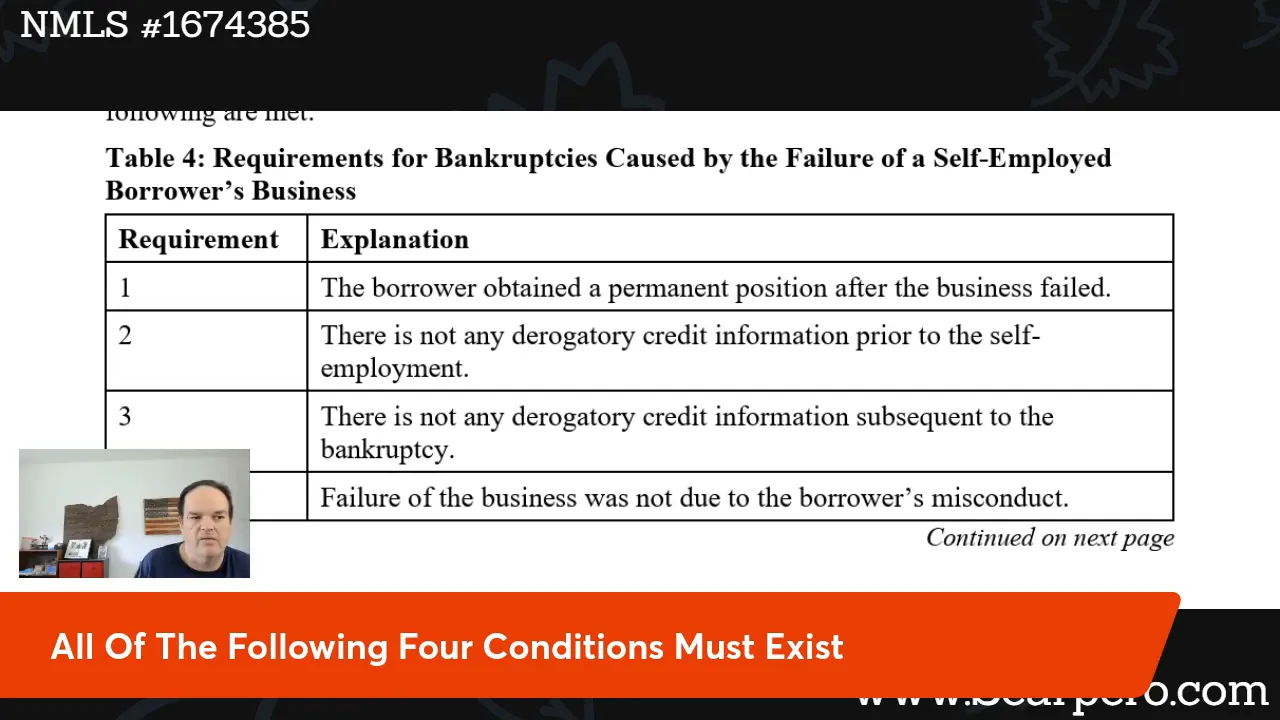

To benefit from this reduced waiting period, you must meet four strict criteria. These ensure that the bankruptcy was truly an extenuating circumstance related to business failure and that you are now on a stable financial path.

Meeting these conditions essentially proves that your life was financially stable before starting the business, the business failure was an unfortunate event, and now you are on a positive path with stable employment or income.

The VA and FHA understand that business failures can happen to even the most responsible borrowers. This rule acknowledges that a bankruptcy caused by business failure is an extenuating circumstance deserving of leniency. It helps borrowers who are genuinely rebuilding their lives get back into homeownership faster.

It also discourages serial entrepreneurship where borrowers repeatedly open and close businesses, which can be risky for lenders.

While this rule is a great benefit, there are some important factors to keep in mind:

This guideline is especially valuable for:

If you or someone you know fits this profile, understanding this rule could be a game-changer in your home buying journey.

A: Yes, you can apply and even go under contract before the waiting period ends. However, the closing date must be after the waiting period has expired.

A: No. For Chapter 13 bankruptcy, the waiting period is based on the filing date and making 12 on-time payments, regardless of self-employment. The reduced waiting period primarily applies to Chapter 7 bankruptcy caused by business failure.

A: Restarting the same or a similar business usually disqualifies you from the reduced waiting period. The VA and FHA want to see stable employment unrelated to the failed business.

A: Lenders will review credit reports, tax returns, and LLC or business filings to determine when your self-employment began to ensure no derogatory credit existed prior.

A: Not necessarily. Some lenders have overlays that require longer waiting periods. Working with an experienced mortgage broker or lender knowledgeable about VA and FHA guidelines is critical.

Understanding the unusual VA and FHA loan qualification rule after a business bankruptcy can open doors for many borrowers who thought they had to wait longer to buy a home. If your bankruptcy was caused by business failure, and you meet the four key conditions, you might qualify for a reduced one-year waiting period instead of the usual two years.

This rule reflects a compassionate and practical approach to lending, recognizing that life’s setbacks don’t have to permanently derail your homeownership goals. If you’re considering buying a home after a business bankruptcy, make sure to seek expert advice and explore this option thoroughly.

If you have questions or need guidance navigating VA or FHA loans after bankruptcy, reach out to a seasoned mortgage professional who can help you understand your options and get you on the path to homeownership.

Can You Have Multiple Properties With A Single VA Loan? You’re trying to buy a property and it includes more than one parcel or lot

How To Get A VA Loan When You Work On Commission If you earn commission instead of a steady salary, qualifying for a VA loan

Can You Refi a VA Loan With Bad Credit? If you have a VA loan and a low credit score, you might assume refinancing is