The 6 Most Common Mistakes That VA Homebuyers Make

Template The 6 Most Common Mistakes That First Time VA Homebuyers Make Buying your first home using a VA loan is an exciting milestone, especially

Carlos Scarpero- Mortgage Broker

First off, let’s talk about why bonus entitlement is important. If you’re in the position of having multiple VA loans simultaneously—maybe you’re relocating for a PCS move or simply want to keep your current home while buying another—you need to understand your remaining entitlement. This is the amount of VA-backed loan benefit you have left to use without having to put money down.

Even if you qualify for both loans based on income and credit, the VA entitlement piece determines if you might owe a down payment on the new home. Why? Because VA loans don’t have a fixed dollar limit. Instead, your entitlement limits how much the VA will guarantee. If you’re “maxed out” on your entitlement, you’ll have to bring some cash to the table.

Just a quick heads-up: there’s a minimum loan size to consider, which is $144,000. While it’s rare to encounter this nowadays, especially in places like Ohio where I’m based, it’s still something to keep in mind when planning your next purchase.

Before diving into calculations, you’ll want to have a few things ready:

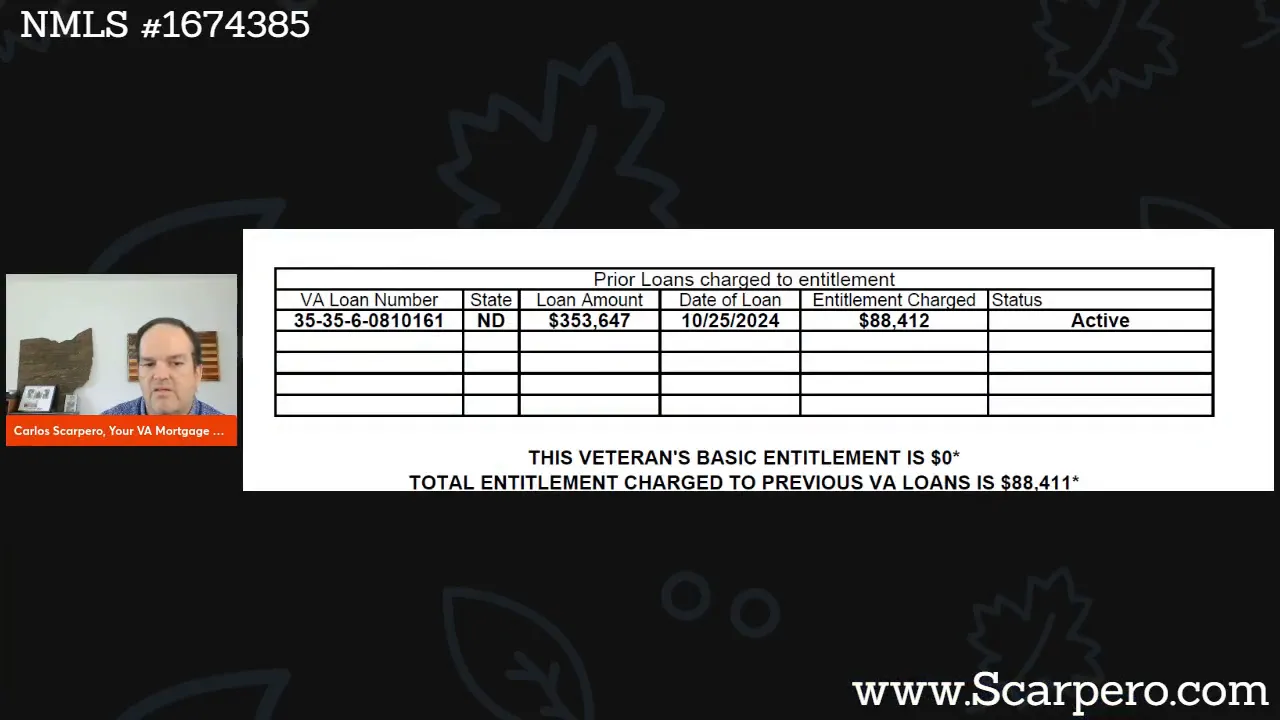

Your COE is essentially your VA loan “scorecard.” It lists your active loans, the amount of entitlement used, and other key info. For example, you might see something like this:

On this COE, you can find the “entitlement charge” number, which represents how much of your entitlement is currently tied up in an active loan. In my example, it’s $88,412. This is the key number you’ll plug into the calculator.

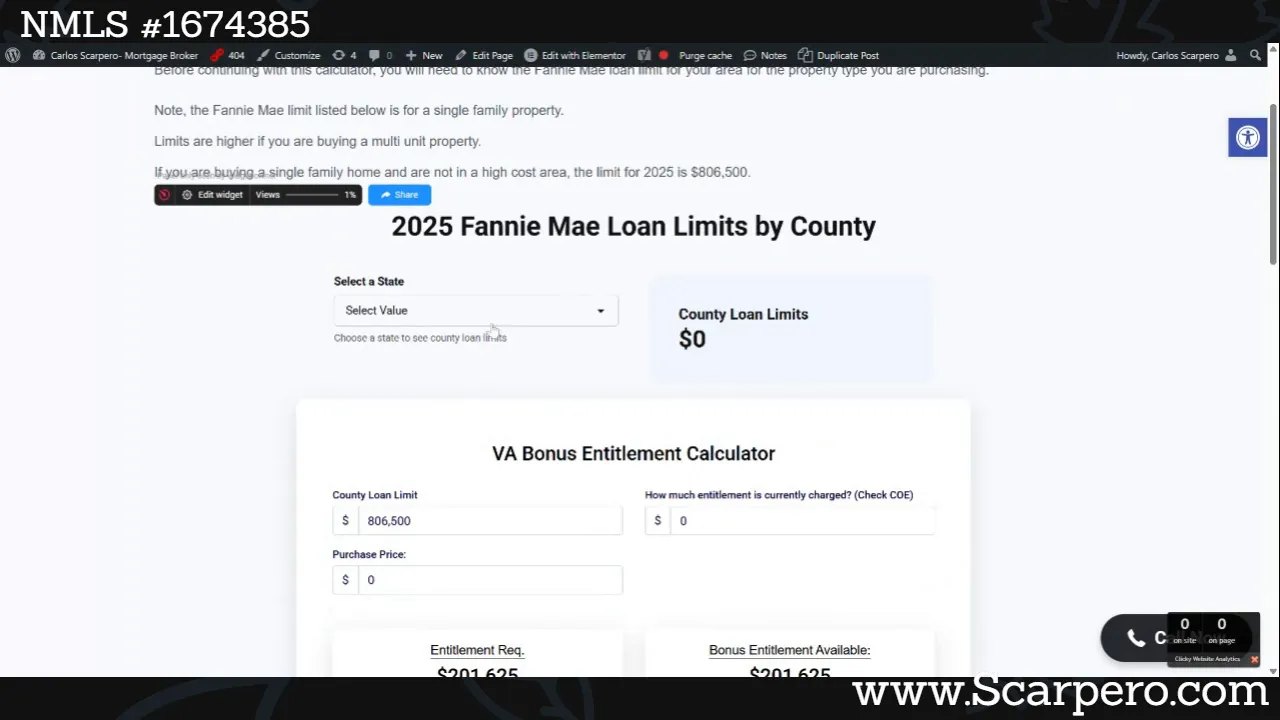

Now, let’s get to the fun part — using the calculator. You can find my free online VA bonus entitlement calculator at scarpero.com/va-bonus-entitlement-calculator. It’s designed to make this process super easy, even if you’re not a mortgage pro.

Here’s a quick walkthrough of how to use it:

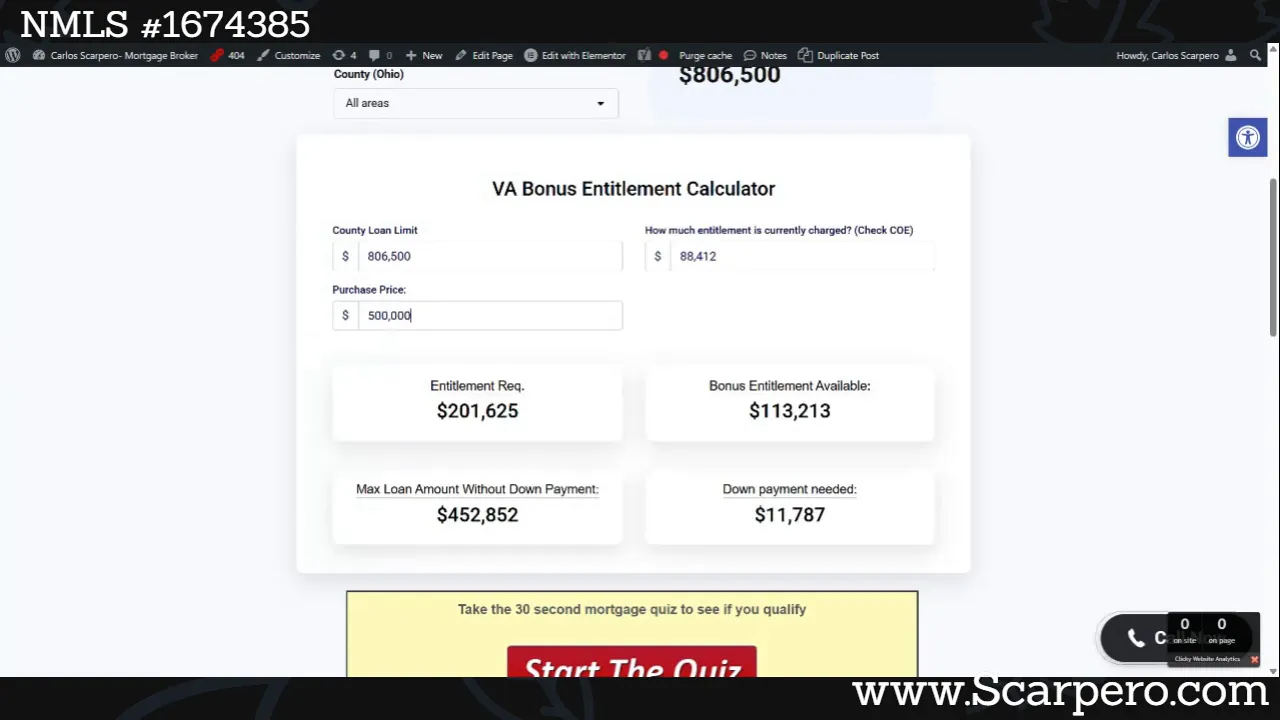

Once you enter these details, the calculator tells you how much you can borrow with zero down based on your remaining entitlement. In the example, with an $88,412 entitlement charge and an $806,500 loan limit, you could buy up to around $452,852 with zero down.

Good question! Let’s say you want to buy a home priced at $500,000. The calculator will show you how much down payment you’d need to cover the difference due to limited entitlement. In this case, it’s approximately $11,787.

Remember, while you still need to qualify for both loans financially, this entitlement calculation tells you if a down payment is required. It’s a critical step in your home buying process when using VA benefits multiple times.

Even seasoned mortgage professionals can get tangled up trying to do these calculations by hand. The VA bonus entitlement rules and loan limits can be confusing, and mistakes can cost you money or cause delays in your approval.

That’s why I built this calculator—to help you quickly and accurately determine your remaining entitlement and understand your buying power. No more guesswork, no more multiple phone calls trying to get the numbers right.

A: Bonus entitlement is the additional VA loan benefit you get when you already have an active VA loan. It allows you to use your VA home loan benefits again without having to pay a down payment, up to certain loan limits.

A: Not necessarily. It depends on your remaining entitlement and the loan limits in your area. If your entitlement is maxed out, you may need a down payment. The calculator helps you figure this out.

A: Multi-unit properties have different loan limits than single-family homes. You need to check the Fannie Mae limits for your county and property type and enter those into the calculator for an accurate result.

A: You can request your COE through the VA’s eBenefits website or ask your lender to help you obtain it. It shows your entitlement usage and is necessary for calculating your bonus entitlement.

A: Yes! You just need to know the correct loan limits for the county and state where you’re buying the property. You can find these limits on the Fannie Mae website or your lender can provide them.

Understanding your VA bonus entitlement is key to maximizing your VA home loan benefits, especially if you’re managing multiple loans. Using my free online VA bonus entitlement calculator takes the confusion out of the process and helps you plan your next home purchase with confidence.

If you have any questions or want to talk through your specific situation, don’t hesitate to reach out to me directly at (937) 572-3713. I’m here to help you make the most of your VA benefits and get you into the home you deserve.

Remember to bookmark the calculator page and keep it handy as you look at different homes—it’ll save you time and headaches!

Template The 6 Most Common Mistakes That First Time VA Homebuyers Make Buying your first home using a VA loan is an exciting milestone, especially

500,000 More Home Sellers Than Buyers? Don’t Believe the Hype Table of Contents Key Takeaways Understanding Redfin’s Viral Housing Study Contrasting Data from Realtor.com and

Template Edge Home Finance Is Hiring Loan Officers Table of Contents Key Takeaways Why commission structure matters: keep what you earn True broker relationships, with