Can You Have Multiple Properties With A Single VA Loan?

Can You Have Multiple Properties With A Single VA Loan? You’re trying to buy a property and it includes more than one parcel or lot

Carlos Scarpero- Mortgage Broker

When it comes to qualifying for a VA home loan, one of the most common questions I get asked is, "Can a second job or additional income source be used for qualifying income?" The answer is nuanced, and it depends largely on the VA handbook guidelines, borrower history, and the specifics of the income sources.

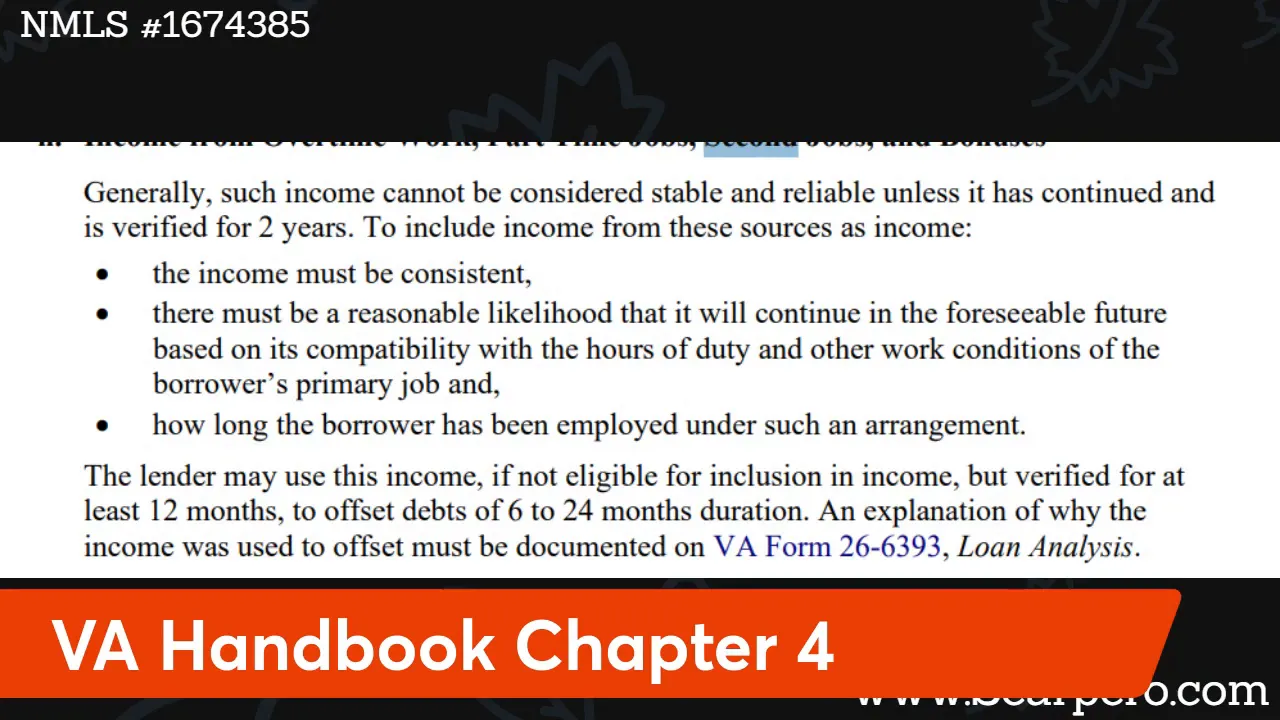

In the VA handbook, particularly in chapter four, the rules around second income are clearly outlined. The key phrase that lenders focus on is "generally". According to the handbook, second income cannot be considered stable and reliable unless it has been continued and verified for at least two years. This means the income must be consistent, reasonable, and likely to continue. The VA also allows the use of second income to offset debts, which can be a crucial factor when calculating debt-to-income ratios.

But what does generally mean? It means that while two years of history is the standard, exceptions can be made. This is where things get interesting and where experience with lenders and understanding the guidelines can make a big difference for borrowers.

Let's break down some common scenarios:

If you have a side hustle or self-employment income, the VA requires a clear history of that income. This generally means you need to have filed taxes showing profits from the side business. Many people mistakenly declare losses or offset their income with expenses, which can disqualify that income for loan qualification purposes.

To use side hustle income, you must have at least two years of consistent positive income from that source. If you meet this requirement, you can include it confidently in your qualifying income.

This is a common situation where borrowers work a full-time job and also hold a part-time job. The main concern for underwriters here is workload management. They want to be sure the borrower can handle the combined workload without burning out or quitting soon after closing the loan.

In this case, you still need to show two years of history demonstrating that you can manage both jobs. However, the two years do not have to be with the same exact jobs. For example, if you have been working two jobs for two years but switched the part-time job in the last year, this can still be acceptable as long as you have proven the ability to manage the workload over time.

This is where things get complicated. Many underwriters are hesitant to approve two part-time jobs as qualifying income because it can be seen as less stable or reliable. However, if the combined hours of these two part-time jobs equal a full-time workload (around 40 hours per week), and the borrower has a good credit score and stable employment, there’s a strong case for approval.

Recently, I encountered a borrower working two part-time jobs, each 20 hours a week, totaling 40 hours. Their credit score was excellent at 775, and both jobs were in the same industry. Despite this, many loan officers I surveyed said this scenario wouldn’t work because the income comes from two separate sources.

But the VA handbook uses the word "generally," which means exceptions can be made. I leveraged a resource called Mortgage Currency—a subscription service that helps loan officers verify guidelines and appeal denials. After reaching out to several account executives across multiple lenders, I found one lender willing to approve this scenario. This shows the importance of persistence and knowing how to navigate lender guidelines creatively.

If you find yourself in a situation where your second income cannot be used according to VA guidelines, there are still options available:

The VA does not set a maximum debt-to-income ratio, but individual lenders often do. Some lenders are more flexible and allow debt-to-income ratios as high as 65%. While that might sound risky, if your second income is not included, the actual debt-to-income ratio might be lower than it appears on paper.

Working with a full-service mortgage broker who has access to a variety of lenders can help you find one that will approve loans under these more lenient conditions. Retail lenders and banks typically have fewer options and less flexibility, so they may not be able to approve such loans.

Non-qualified mortgage (Non-QM) loans are portfolio products outside the VA loan program. These loans include bank statement loans, mixed income loans, and even no income verification loans. They are designed to be more flexible and creative in evaluating a borrower's entire financial picture.

Non-QM loans often come with higher interest rates and are usually considered a last resort. However, if you have multiple jobs or non-traditional income sources that don't fit VA guidelines, they can be a viable option.

One of the biggest advantages of working with a mortgage broker like me is access to multiple lenders and products. I work with over 150 lenders, many of which are VA-approved. This variety gives me the ability to shop around and find lenders willing to approve unique or challenging income situations.

For example, the borrower with two part-time jobs was initially told "no" by many lenders. But because I have multiple options and know how to interpret guidelines, I was able to get that loan approved. This kind of creativity and persistence is what you need when qualifying income sources are complicated.

Qualifying second income for VA loans can be straightforward or complex depending on your employment situation. The VA handbook is clear about requiring two years of continuous income history for second income sources, but the use of the word "generally" means there is room for exceptions.

If you have a side hustle, full-time plus part-time job, or even two part-time jobs, it’s essential to understand how your income history affects your loan approval. When in doubt, working with a mortgage broker who understands the nuances of VA guidelines and has access to multiple lenders can be the key to success.

And if your second income doesn't qualify under standard VA guidelines, don't lose hope. High DTI lenders and Non-QM loan products offer alternative pathways to homeownership.

If you have questions about VA home loans or your specific income situation, feel free to reach out. I’m here to help guide you through the process and find the best solution for your needs.

Yes, but the side hustle income must be stable and verifiable for at least two years. You’ll need to provide tax returns showing consistent profits.

Potentially yes, especially if the combined hours total a full-time workload and you have a strong credit profile. This is considered a gray area and may require working with lenders who are willing to make exceptions.

You can explore lenders with higher debt-to-income ratio allowances or consider Non-QM loans, which offer more flexibility but usually at higher rates.

Lenders want to ensure you can manage the workload and maintain stable income. They are concerned about the risk of burnout or quitting a job shortly after loan closing.

A broker has access to multiple lenders and loan products. They can shop around to find lenders who are more flexible with income guidelines and help appeal denials.

You can contact a mortgage professional who specializes in VA loans. For personalized guidance, you can reach me at 937-572-3713 or visit scarpero.com.

Can You Have Multiple Properties With A Single VA Loan? You’re trying to buy a property and it includes more than one parcel or lot

How To Get A VA Loan When You Work On Commission If you earn commission instead of a steady salary, qualifying for a VA loan

Can You Refi a VA Loan With Bad Credit? If you have a VA loan and a low credit score, you might assume refinancing is