Can You Have Multiple Properties With A Single VA Loan?

Can You Have Multiple Properties With A Single VA Loan? You’re trying to buy a property and it includes more than one parcel or lot

Carlos Scarpero- Mortgage Broker

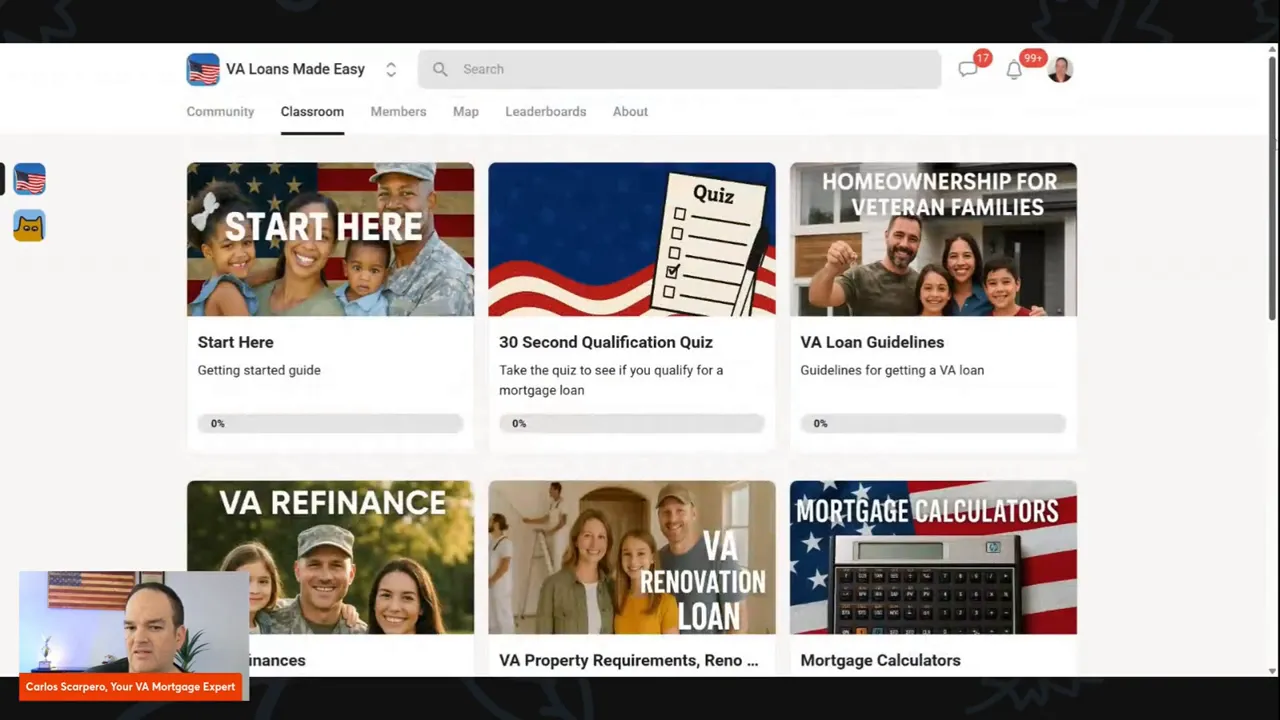

If you’re navigating the VA home loan process, you don’t have to do it alone. This community is a dedicated training hub built to simplify VA mortgages, refinances, and renovation loans while giving you practical tools and answer-driven support. You’ll find clear guides, calculators, expert webinars, and a place to ask real questions.

The community is organized like a classroom so you can move from fundamentals to advanced topics at your own pace. Everything in the training area is designed to answer the most common roadblocks people face when using their VA benefits. Below are the main areas you’ll rely on.

Start with the step-by-step “get started” guide that lays out eligibility, required documents, and the timeline for a typical VA purchase. That’s followed by short lessons on specific guideline questions—useful if your situation has nuances like nonstandard income, prior bankruptcy, or unique employment histories.

The classroom contains many short videos covering core topics: qualifications, appraisal basics, entitlement, funding fees, and more. Each lesson is meant to be practical so you can act on the information the same day.

Instead of juggling spreadsheets or hunting for scattered calculators, you’ll find a whole section dedicated to interactive tools. Use these calculators to estimate payments, compare refinance options, and plan renovations.

Whether you’re looking to refinance to lower your rate or finance a renovation under the VA program, the community breaks the process into manageable steps. You’ll learn what lenders look for, how the VA appraisal works in renovation situations, and which common mistakes to avoid.

Members get access to a copy of the guidebook used throughout the training. The book is also sold publicly, but it’s available inside the community at no charge. Beyond that, curated resources include externally produced webinars and specialist content that complement the lessons.

Examples of curated material you might find:

The community includes a chat area where you can post a question and receive feedback from experts or fellow members. This is where the classroom meets real-world scenarios—ask about an appraisal issue, chat through a refinance quote, or get clarification on entitlement use.

The chat area is meant for practical problem solving. Expect concise answers focused on what to do next, not academic discussion.

The training is intentionally focused on the most common sticking points:

Take the 30 second mortgage quiz to see if you qualify |

| Start The Quiz |

This community is helpful whether you’re actively house hunting, considering a refinance, planning a renovation, or simply exploring your VA mortgage benefits. If you want straightforward guidance and tools that cut through confusion, you’ll find the content useful.

Access to the community, materials, and chat is completely free. The only optional cost is if you choose to buy the physical book rather than download the included copy.

If you want a focused, organized resource center to guide your VA mortgage decisions, this community gives you a toolbox: lessons, calculators, curated specialist content, and a place to ask for help. Join and start by reviewing the get started guide and running a few of the calculators that match your goals.

It’s a free online classroom that organizes training, tools, and curated resources specifically for VA mortgage users. Anyone using VA benefits for purchase, refinance, or renovation can join.

Yes. There are guideline FAQ videos and lessons that address many nonstandard situations, plus an active chat for personalized guidance.

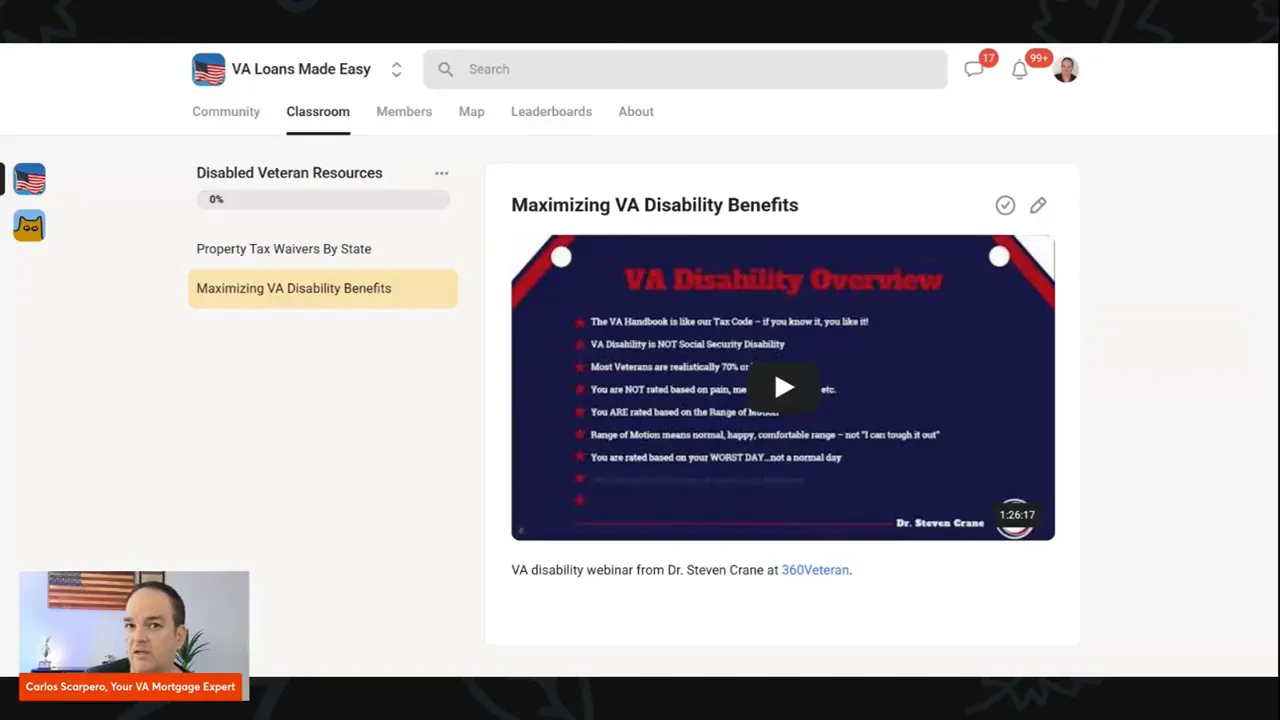

The community includes webinars and materials on VA disability benefits, including strategies to pursue higher ratings and understand how benefits impact your mortgage eligibility.

No. The classroom, calculators, and chat are free. The guidebook is available inside the community at no charge, though a physical copy can be purchased separately.

Response time varies, but questions posted with clear details typically get answered by experts or experienced members quickly. For best results, include numbers, dates, and the specific guideline you’re asking about.

Using your VA benefits for a home should be empowering, not confusing. The community is built to make the process clearer and more actionable so you can move forward with confidence. If you want tools, plain-language guidance, and a place to ask direct questions, this resource is designed for you.

Can You Have Multiple Properties With A Single VA Loan? You’re trying to buy a property and it includes more than one parcel or lot

How To Get A VA Loan When You Work On Commission If you earn commission instead of a steady salary, qualifying for a VA loan

Can You Refi a VA Loan With Bad Credit? If you have a VA loan and a low credit score, you might assume refinancing is