Credit Utilization: The #1 Mistake That Hurts Your Score

Credit Utilization: The #1 Mistake That Hurts Your Score Guest post by Sam Parker at MyCreditGuy Table of Contents Key Takeaways Understanding Credit Utilization: Why

Carlos Scarpero- Mortgage Broker

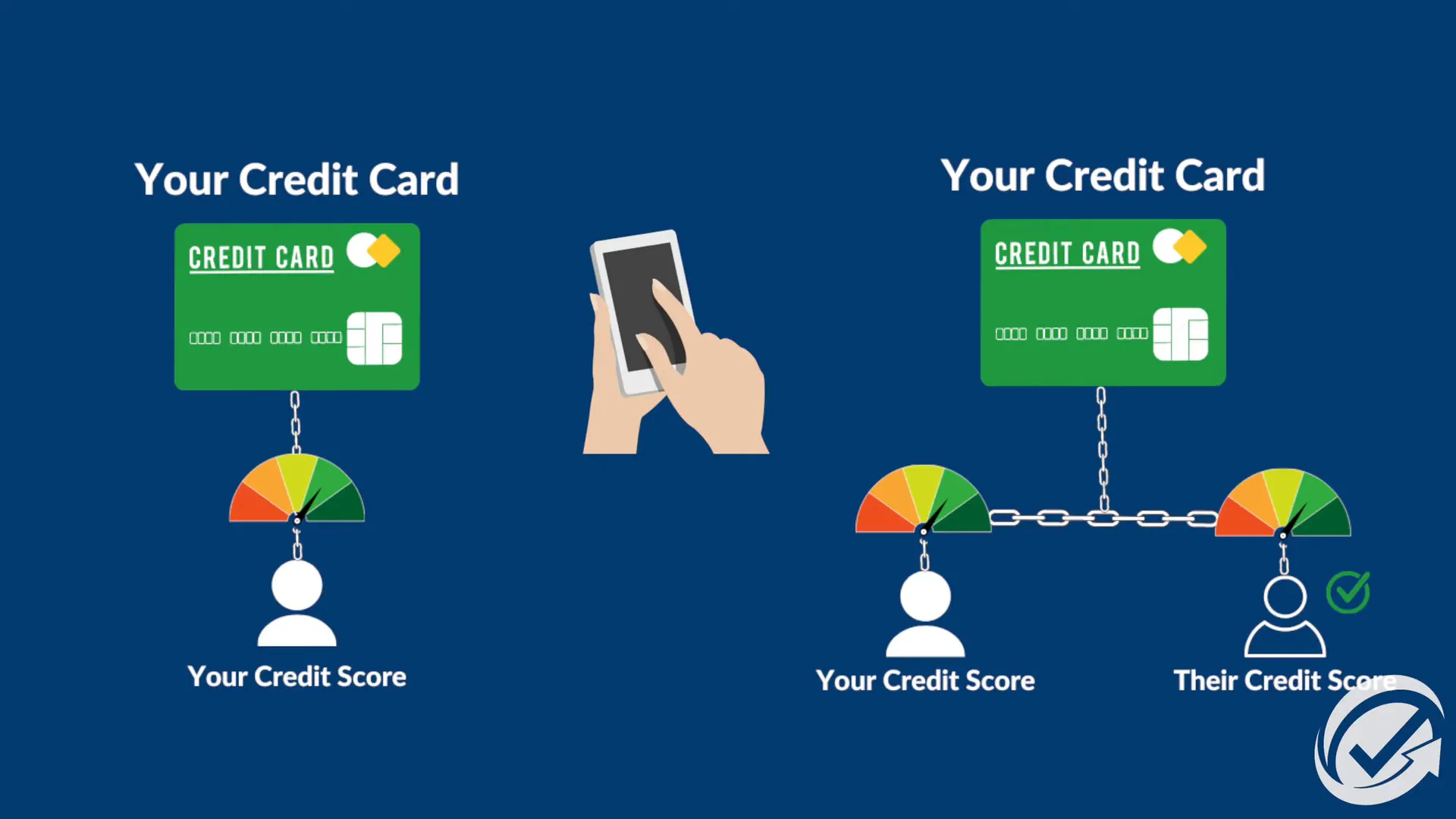

Understanding how authorized users work on credit cards is a powerful tool that many people overlook. Contrary to popular belief, this method remains one of the fastest and most effective ways to improve a credit score when used correctly. In this article, I’ll walk you through everything you need to know about adding authorized users to your credit card account, the benefits, the risks, and how to handle any unauthorized accounts you may find on your credit report.

An authorized user is someone you add to your credit card account who is allowed to use the card but is not legally responsible for the payments. The primary cardholder continues to manage and pay the bills, but the authorized user benefits from the credit history associated with that account.

For example, if I have a credit card that I've been paying on for years, and my wife also contributes to paying that bill, I can add her as an authorized user. Her income indirectly supports the payments, and by adding her, the credit history I've built over time will appear on her credit report within thirty to sixty days.

This means that if the credit card has a strong payment history and low utilization, the authorized user’s credit score can increase rapidly without them having to open a new account or build credit from scratch.

While technically you can add anyone as an authorized user, it’s important to understand the ethical and legal implications of doing so. Adding someone to your credit card who has no connection to you or is not involved in paying the bill is considered fraudulent.

Many banks and credit card companies view this as a violation of their terms of service, and it can lead to serious problems, including account closure or legal action.

The safe approach is to add only immediate family members, spouses, or trusted business partners who share responsibility for the credit card payments. When you call your credit card company to add someone, you’ll need to provide their Social Security number and name. The company will ask you to acknowledge that the account will be reported on the authorized user’s credit report.

Once the process is complete, the credit history of the account should appear on the authorized user’s credit report within a month or two. This is a simple and effective way to help someone build or improve their credit score quickly.

You may come across companies that offer to sell authorized user status on credit cards as a way to boost credit scores. I strongly advise staying far away from these services. They often involve questionable practices that can harm your credit rather than help it.

It's important to build credit through legitimate means, and adding authorized users should be done responsibly within your personal network.

A common concern is whether adding an authorized user could hurt the primary cardholder’s credit score. The answer is no—adding a spouse, immediate family member, or business partner as an authorized user will not negatively impact your credit unless you miss payments.

If you go late on the credit card payment, that negative history will also show up on the authorized user’s credit report. So, while adding authorized users can help them build credit, it also means they share in the credit card’s risk profile.

Sometimes, people discover authorized user accounts on their credit reports that they never authorized or don't want there. This can be frustrating and damaging to your credit score. Fortunately, removing yourself from an unauthorized account is usually straightforward.

All you need to do is call the credit card company and inform them that this is not an authorized use of your credit. You have every right to request removal of that account from your credit report. The credit card company should process this request and stop reporting the account on your credit within thirty to sixty days.

If any institution tries to make this process difficult or requires you to jump through hoops, you can seek assistance from legal professionals specializing in the Fair Credit Reporting Act (FCRA) and Fair Debt Collection Practices Act (FDCPA). I can connect you with attorneys who handle these issues to ensure your rights are protected.

Adding authorized users to your credit card account remains one of the few effective “loopholes” that can quickly improve a consumer’s credit score. Here’s a quick recap of the key points:

A: Typically, the credit history shows up within 30 to 60 days after being added as an authorized user.

A: While it’s technically possible, it’s not recommended. Adding someone with no financial connection to you is considered fraudulent and can cause problems with your credit card issuer.

A: Adding a trusted authorized user like a spouse or family member will not negatively impact your credit score. However, missed payments on the account will affect all users.

A: Contact the credit card company immediately and request removal from the account. You have the right to be removed, and the process should take 30 to 60 days.

A: No. These companies often use unethical practices and can harm your credit. It’s best to avoid them and build credit through legitimate means.

Adding an authorized user to your credit card is a simple, effective way to help someone build or improve their credit score quickly, especially when done with close family members or trusted partners. By understanding the process, the rules, and the potential risks, you can leverage this strategy responsibly.

Remember, maintaining good payment habits on the primary account is essential because the authorized user’s credit will reflect both positive and negative activity. If you ever encounter unauthorized accounts on your report, act quickly to remove them and protect your creditworthiness.

For more tips on credit improvement and to get started with adding authorized users correctly, visit My Credit Guy and join the community focused on helping you achieve financial freedom.

Credit Utilization: The #1 Mistake That Hurts Your Score Guest post by Sam Parker at MyCreditGuy Table of Contents Key Takeaways Understanding Credit Utilization: Why

Can You Get A VA Loan With Bounced Checks? Table of Contents Key Takeaways Introduction Understanding the VA Handbook and Bounced Checks Lender Overlays and

VA Reno vs 203k: Which Renovation Mortgage Program Is Best? Table of Contents Key Takeaways What Is a Renovation Mortgage? The VA Renovation Loan: Benefits